Management decisions to use a labor-intensive rather than a capital-intensive approach can affect this ratio.

#CALCULATE FIXED ASSET TURNOVER RATIO SOFTWARE#

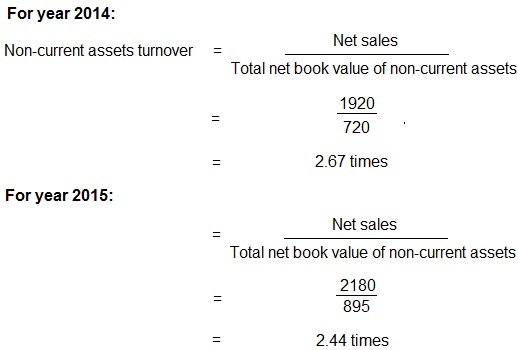

For example, utility companies have a more extensive asset base than software companies. Different sectors have different asset structures. Inventory turnover or account receivable turnover are other examples of activity ratios.ĪTR analysis should consider the sector or group the company is operating in. These are called activity ratios or efficiency ratios. The analysis should also include other relevant ratios, such as Working Capital Turnover Ratio and Fixed Asset Turnover Ratio. It should be considered that this ratio alone is not an indication of asset management efficiency. Comparing these numbers, we find that Pfizer was more efficient in using its assets than most other pharmaceutical companies.Ī higher ratio indicates better efficiency in managing assets to generate revenue. Major pharmaceutical companies had an average of 0.45 in the year 2021. Novartis, one of the major competitors of Pfizer, had an Asset Turnover Ratio of 0.4. This means in 2021, with every dollar worth of assets, Pfizer could generate $0.48 in revenue. The following is Pfizer's Balance Sheet and Income Statement according to their Form 10-K, which they submitted to the SEC:Īverage Asset = ($154,229 + $181,476)/2 = $167,852.5 Let us understand this with a simple example: Average assets: The average assets can be calculated by taking the beginning total assets(total assets of the previous year) and total assets of the current period from the Balance Sheet and averaging them out. The term net revenue is sometimes used in the Income statement to indicate that the revenue has been adjusted with the mentioned deductions.Ģ.

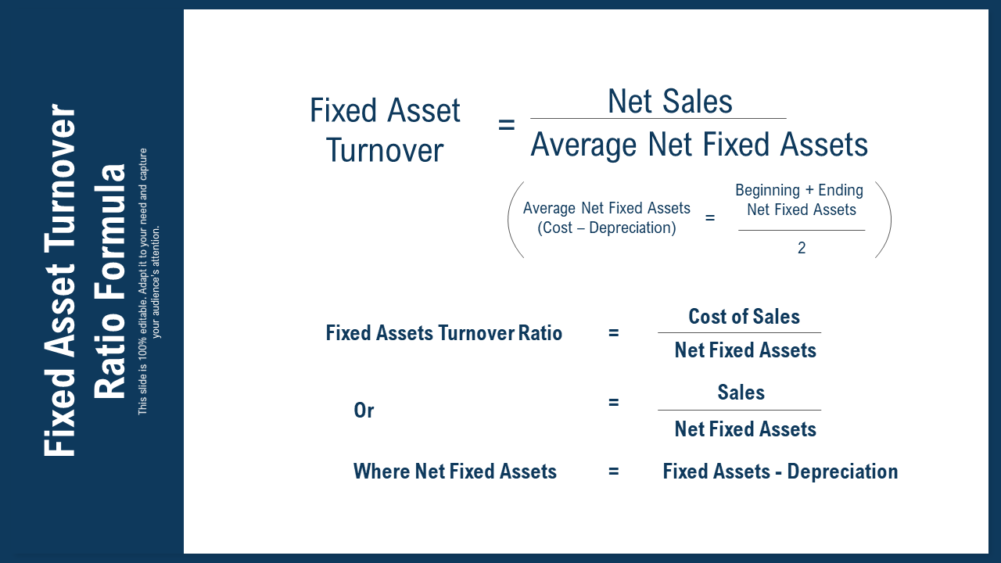

Net sales: Revenue is reported after adjustments for discounts, returned goods, or other reductions.

A general rule of thumb is that a higher ratio means more efficient use of the company's assets.Īsset Turnover Ratio = Net Sales/Average Assets.ġ. However, It is helpful to analyze the Working Capital Turnover Ratio and Fixed Asset Turnover Ratio separately to understand revenue-generating assets better. Investors and analysts can use this measure to compare similar companies to know how efficiently they use their assets. Other than that, ATR can calculate ROE( Return On Equity) in Dupont analysis. In addition, asset turnover can be affected by factors other than a company's efficiency.įor example, the ratio would be lower for a company with newer assets that are not yet depreciated and have a higher carrying value in the Balance sheet compared to that of a company with older assets that are highly depreciated.Īnalysts use activity ratios to measure the company's efficacy in using assets to generate revenue.

#CALCULATE FIXED ASSET TURNOVER RATIO FULL#

This ratio includes the average of both fixed and current assets.Ī low ratio may indicate lower efficiency these are usually companies in a capital-intensive sector or industry or a new business that is just starting up and is not yet operating at full capacity. The Asset Turnover Ratio(ATR), or sometimes the Total Asset Turnover Ratio, generally measures the company's ability to earn revenues with its assets in a given period.įor instance - A ratio of 1.3 indicates the company can earn $1.3 of revenue for every dollar of average assets.Ī higher number means greater efficiency in generating revenue.

0 kommentar(er)

0 kommentar(er)